Bank anywhere with SPXFCU Mobile Banking. Sign up for SPXFCU iBanking – our free online access – then download our SPXFCU mobile app. You can check balances, pay bills, make transfers, and so much more from home or on the go. What are you waiting for? Sign up for mobile banking today!

Sign up for Online Banking Today!

Already Signed Up? Login to your Account!

iBanking Online Banking

Take care of your finances from wherever you have internet access with SPXFCU iBanking. Manage your accounts 24 hours a day, 7 days a week, right from your computer. It’s safe, easy to use, and, best of all, free for all members. Conduct secure, confidential transactions and inquiries, including:

- Check account balances and transaction history

- Transfer funds instantly between your SPXFCU accounts

- Make loan payments

- Submit secure, confidential loan applications

- Change your username and password

- View your next loan payment due date, payoff amount and interest rate

- Find out which checks have cleared

- Sign up to view your statements online with eStatements

With FREE Online Bill Pay1, you can pay anyone at any time, from anywhere that you can access your account online. Bill Pay offers you the ability to pay your bills from one simple-to-use site. Plus, your payments can be scheduled so you don’t miss due dates. With Bill Pay services, you’ll be able to:

- Arrange email alerts for bill arrivals, due dates, and upcoming payments

- Receive confirmations when your payment has been sent

- View past payments

- Schedule automatic recurring payment rules for each payee

- Use multiple funding accounts to pay your bills

- And much more!

1The Bill Payment option is free to all SPXFCU members. Bill payments will be made electronically through the ACH (Automated Clearing House). If the vendor to whom you are making your payment does not accept payments electronically, checks will be cut and mailed directly to them. Electronic payments may take 3 – 5 days to be received. Check payments may take up to 10 days.

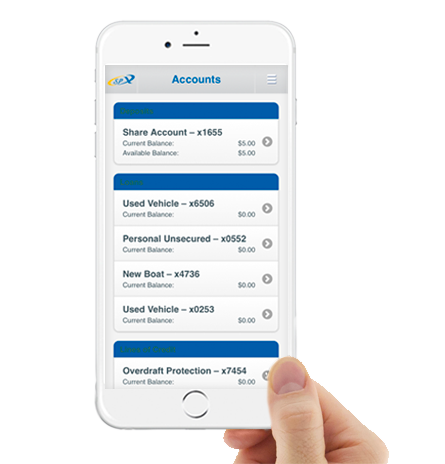

Download our Free Mobile App!

With the free SPXFCU Mobile Banking App, banking on the go has never been easier! If you already have signed up for free SPXFCU online access, then simply download our mobile app and let your fingers do the banking. Not only is the SPXFCU Mobile Banking App free, it has a multitude of features that make banking easy, including:

- Check Account Balances & Transactions

- Recent Activity Tracking

- Fund Transfers

- Bill Pay

- Mobile Check Deposits